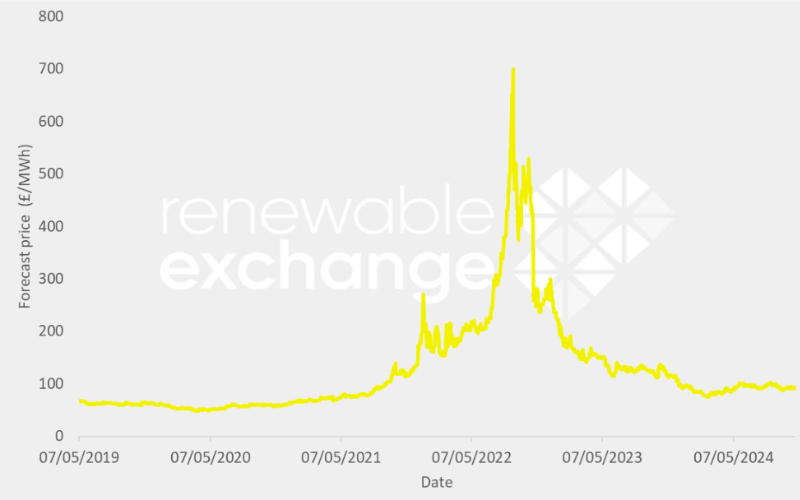

Understanding wholesale electricity prices can be complex, but energy markets, much like other commodities, are influenced by the principles of supply and demand. When energy supply is constrained, prices naturally rise; conversely, an increase in supply drives prices downward. The same relationship holds true on the demand side: heightened demand pushes prices higher, while a decrease in demand exerts downward pressure on prices. An example of an energy fundamental is weather. For example, when there is more wind we have strong wind generation and this increases the supply – driving down prices. When we have cooler weather we have an increase in demand for power-for-heating, driving prices upwards. And these fundamentals are all impacting price simultaneously, making predicting wholesale prices such a complicated exercise. Let’s take a chronological look at how these factors played out over the past few years.

2020: A Year of Low Demand and Prices

The COVID-19 pandemic created conditions which resulted in an extraordinary year for the electricity market. Lockdown restrictions imposed in March 2020 caused a dramatic reduction in overall electricity demand, which fell well below normal levels. On Thursday 5th March 2020, peak demand was 46GW. At the same time 5 weeks later, once lockdown had been imposed, peak demand was 30GW, a decrease of almost 35%. Alongside favourable weather and an abundance of renewable energy generation, electricity prices plummeted, particularly during the first lockdown. Day-ahead baseload prices fell to a monthly average of just over £24/MWh in April 2020, from an average of just under £44/MWh in April 2019.

The overall decrease in electricity prices was driven not only by reduced demand but also by lower gas prices. In the UK, electricity prices are closely tied to the price of gas-fired power, as we rely on gas-fired power to meet peak electricity demand. The availability of cheaper gas meant that electricity prices remained low throughout most of 2020. The average day-ahead electricity price was £35.26/MWh for the year of 2020.

2021: The Return of High Demand and Price Spikes

By 2021, demand had returned to pre-pandemic levels, but as demand picked up, the situation changed dramatically. Gas prices surged due to a variety of factors, including increased global demand, low gas reserves, and geopolitical tensions in Europe, notably around the Nord Stream 2 pipeline.

The increased demand due to the end of the lockdown was further intensified by a cold winter. The winter of 2020–2021 was colder than usual, leading to even greater demand for gas to heat homes, which depleted gas reserves across Europe. Moreover, renewable energy production, particularly wind power, was lower than expected due to extended periods of low wind. This forced a higher dependence on fossil fuel-based electricity generation, contributing to the price increase seen in 2021.

2022: Record High Prices and Global Disruption

The start of the Russia-Ukraine war in early 2022 caused unprecedented turmoil in global gas markets. Russia, a key supplier of gas to Europe, drastically reduced gas exports, driving prices to all-time highs. The UK’s wholesale electricity prices followed suit, as gas-powered plants remained the marginal cost setters for electricity. By the end of Q1 2022, average day-ahead electricity prices had increased by 72% compared to the previous year.

Throughout 2022, various other factors kept prices elevated. A shortage in the French nuclear fleet, caused by low rainfall and high temperatures, led the UK to export large volumes of electricity to France, adding further pressure to domestic prices. Typically, the UK imports a large volume of electricity from France over the winter period. Low water levels in Nordic countries and droughts across Europe reduced hydroelectric generation, further increasing the UK’s export obligations and contributing to historically high electricity prices. Quarterly forward wholesale power prices reached a weekly average of £511.20/MWh during the week of the 22nd August 2022.

This graph uses forecast data generated by Renewable Exchange for a site registered on our platform. The forecast includes power price, embedded benefits and certificates specific to this site. It demonstrates the trends in the power market and how this affected PPA pricing.

If you want to get a PPA forecast specific to your renewable asset, please fill out this registration form, or contact us at [email protected]. If you are already registered on the platform, log in here.

2023: A Gradual Decline

After two years of extreme price volatility, 2023 saw some relief in the form of lower electricity prices. A relatively mild winter across Europe helped reduce gas demand, and the efforts of households and businesses to conserve energy, driven by fears of unaffordable bills, contributed to an overall decrease in demand. Gas prices, which had soared in 2022, began to stabilise as European countries successfully replenished their gas reserves, and France’s nuclear fleet returned to higher levels of availability.

In the first quarter of 2023, electricity demand was significantly lower than usual—around 10% less than expected—whilst strong wind output further reduced reliance on gas-fired power plants. Gas prices dropped by 42% compared to Q1 2022, which helped drive down electricity prices across the board.

By the second quarter of 2023, demand had continued to decline, reaching its lowest levels since Q2 2020. This sustained downward trend on demand, coupled with more stable gas prices, kept electricity prices lower, and the UK market continued to recover from the disruptions of 2022.

By the end of 2023, electricity prices had stabilised somewhat, though they remained higher than their pre-pandemic levels. Events like the Israel-Hamas conflict in late 2023 caused some spikes, but these were less severe than those seen with the Russia-Ukraine war in 2022. Looking forward, much will depend on the continued geopolitical stability of Europe, weather patterns affecting renewable generation, and global gas markets. Nonetheless, the experience of the past few years underscores how interconnected the UK’s electricity prices are with global energy markets and events.

The wholesale power market remains dynamic, and while recent trends point to some stabilisation, uncertainty remains. As renewable energy capacity increases and gas reliance decreases, we may see more sustainable and predictable pricing into the future. As renewable energy generation is intermittent, we will also need more battery storage to ensure consistent supply.