The Government has recently announced that there will now be annual (rather than bi-annual) Contracts for Difference (CfD) auction rounds. The decision follows public consultations around the scheme and supports the UK’s revised energy strategy focused on increased development of renewable generation. The CfD auction rounds will run every year starting March 2023.

CfD Auction Round 4 opens for bids

We’ve also just entered the key phase of the Allocation Round 4 (AR4) – the auction stage opened on the 24th May and qualified applicants can now submit their sealed bids until the 15th June. The outcomes of the auction will be announced early in July, followed by formal offers being issued between July and August to successful generators.

Successful CfD applicants will now have to think about their route to market strategy and the best options for the projects’ commercial success. In this blog, we’ll look at effective PPA structuring for CfDs and how to optimise other elements of your export power revenue.

You’ve been offered a CfD – what next?

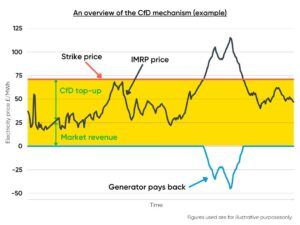

In the CfD scheme, LCCC (the governing body) considers only the difference between the Intermittent Market Reference Price (IMRP) and the strike price agreed in the contract. Where the strike price is above the IMRP, LCCC will issue a top-up payment. Where the strike price is below the IMRP, the difference has to be paid back to LCCC. The IMRP is calculated as a volume-weighted average of the two day-ahead auctions: EPEX and N2EX.

Generators must remember and factor into their bid that they will not receive the full strike price from the LCCC, but only the top-up to the IMPR. They will therefore need a power purchase agreement (PPA) that will pay them the day-ahead price on outturn generation (market revenue element of the graph above).

PPA contract structuring

A variable (rather than fixed) PPA is usually the preferred option for a CfD generator to ensure the final revenue (market revenue with the CfD top-up) can oscillate around the strike price. This guarantees a fairly stable revenue stream throughout the duration of the contract.

The PPA price will come at a discount to the index price as a result of the balancing costs that the PPA offtaker (buyer) incurs. There are generally two options for structuring the discount: either as a fixed amount (in £/MWh) or as a percentage value (e.g. 98% of EPEX day-ahead price).

When looking for a PPA, you have to consider which index you’d want it to link to: one of the auctions (N2EX/EPEX) or the IMRP (published on the Settlement Data webpage). There are some basic risks associated with choosing either option as there are some small differences between the prices captured between them.

Read more about the differences between variable and fixed-price PPAs.

When to start looking for a PPA?

The CfD offer stipulates required milestones and project commitments which must be met to preserve the term for payments; e.g. 80% of initial capacity estimate must be commissioned within the target commissioning window.

A short-term PPA (6 months – 2 years) can be arranged if a project is commissioned ahead of the CfD agreed start date to maximise export power revenue while wholesale power prices are high.

You can easily lock in a well-optimised PPA contract, even for a newly commissioned site or a project in development, on the Renewable Exchange platform. You can launch a PPA tender and secure the contract in just a few days.

Renewable Exchange can offer you no-obligation independent advice about your project and structuring a PPA. Get in touch to schedule a chat with one of our PPA Experts!

If not a CfD, then what?

Since 2021 wholesale power prices have been rising and more and more unsubsidised projects get off the ground by obtaining high-value fixed PPAs. In the current market, developers decide whether to bound themselves by the CfD scheme which offers long-term price stability, or to sell their power into the fixed-price PPA markets, or directly into the wholesale market (for integrated companies with a supply licence).

CfD strike price is RPI-linked, and is likely to clear in the £60-70/MWh range. The contract term is usually of 15 years and guarantees stable (but not maximised) returns.

Wholesale markets have a different price every hour, but have been clearing at over £200/MWh consistently throughout the last 6 months. There’s an inevitable risk related to power trading. For intermittent technologies the additional risk is due to the fact that often the more renewable generation is fed into the grid, the lower the price is at the time.

PPA markets can deliver 10 year fixes above the estimated CfD strike price, but are typically not RPI-linked. On the other hand, short-term PPAs are the most popular solution where the contracts are signed in 1-2 year increments leaving the option for the generator to adjust their strategy should the power market change dramatically.

What about REGOs?

In the past, REGOs weren’t worth a lot and many generators didn’t pay much attention to them. However, with the growing consumer interest and changing policies supporting renewables in the UK, the value of REGOs has increased significantly over the last couple of years. (See our latest REGO Index update).

With Renewable Exchange, REGOs can be traded as part of a PPA or independently. Many generators under the CfD contract decide to detach REGOs from their export power sales and use them to recover some of the balancing discounts of the PPA.

You may employ various strategies when it comes to selling REGO certificates: setting up a structured offtake or selling them in fixed volume chunks. With a good strategy, you may even be able to achieve total project revenues (market revenue component + CfD top-up + REGO value) above the strike price target.

As the auction begins…

In light of high wholesale power prices, developers of new renewable energy assets in the UK are faced with a serious dilemma. There’s lots to consider when commercially structuring your route to market and understanding which option is the best for a particular project: CfD, fixed-PPA or other?

In these unprecedented times for renewable energy developments, we wish all generators the best of success in this CfD auction round.

For any support on structuring CfD-specific PPAs, or just a confidential conversation to expand on areas discussed in this blog, reach out to our team: [email protected]